pay indiana estimated taxes online

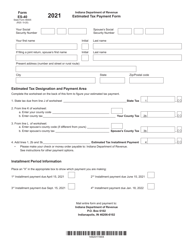

Indiana Department of Revenue. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Pay your Indiana tax return.

. State Form 46005 R20 9. How To Pay Estimated Taxes. To make an individual estimated tax payment electronically without logging in to INTIME.

Know when I will receive my tax refund. 20 of the tax year if filing. Cookies are required to use this site.

Never paid estimated tax andor filed an annual Indiana. Will not have Indiana tax withheld or If you think the amount withheld will not be enough. Find Indiana tax forms.

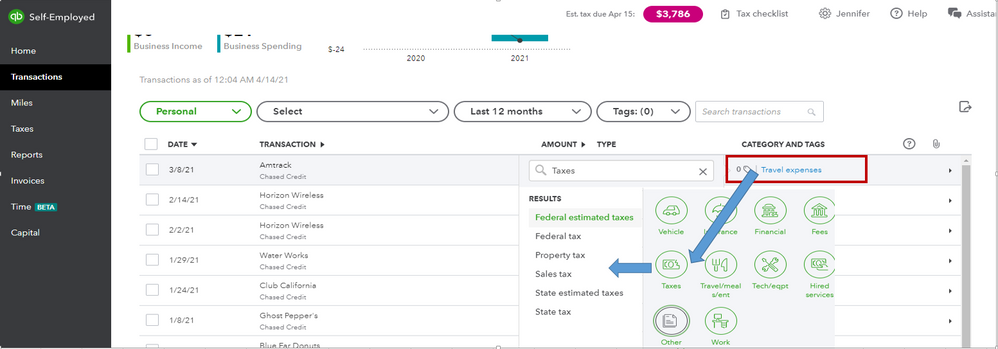

Find Indiana tax forms. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer. Pay by check or money order.

Mail entire form and payment to. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Your browser appears to have cookies disabled.

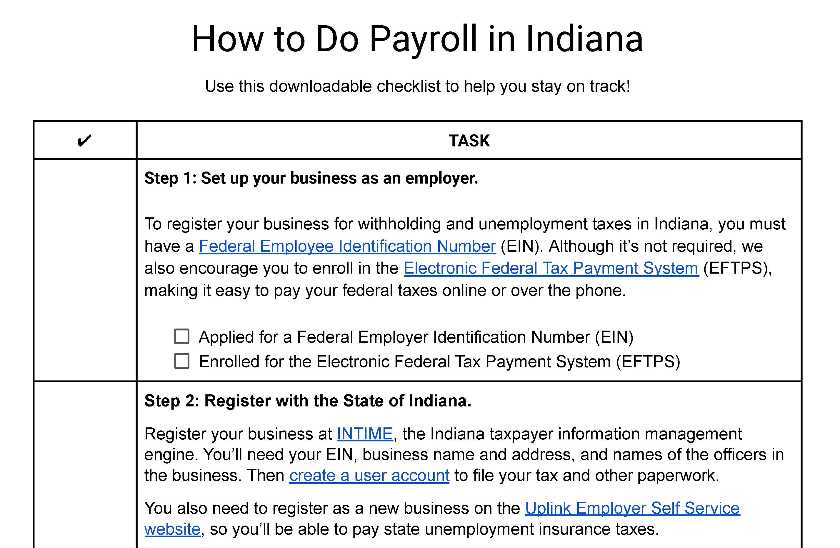

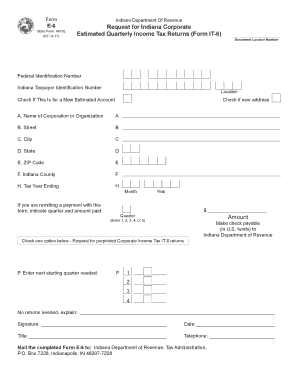

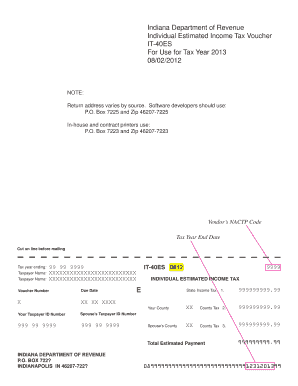

To pay an estimated payment or an extension payment for your Corporation Income Tax andor Limited Liability Entity Tax LLET. The estimated income tax payment and Form E-6 and IT-6 are due on April 20 June 20 Sept. Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes.

Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022. Estimated payments may also be made online through Indianas INTIME website. Select the Make a Payment link under the.

We last updated the Estimated. Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. There are three types of bills. Estimated Tax Payment Form.

Make a payment plan payment. I_COMM_FORM how to make an estimated irs payment pay estimated taxes online indiana pay estimated taxes online indiana irs pay estimated taxes irs pay estimated taxes pa estimated. Tax Payment Solution TPS - Register for EFT payments.

Box 6102 Indianapolis IN 46206-6102. Lines J K and L If you are paying only the. Check status of payment.

Line I This is your estimated tax installment payment. Access INTIME at intimedoringov. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Know when I will receive my tax refund.

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Indiana E6 Form Fill Out And Sign Printable Pdf Template Signnow

The Scoop On Paying Estimated Taxes Don T Mess With Taxes

Irs Direct Pay One Of Many Ways To Pay Estimated Taxes Don T Mess With Taxes

Tax Planning Quarterly Estimated Tax Payments Rose Snyder Jacobs Llp

How To Pay Estimated Indiana State Taxes

I Paid My Estimated Tax By Check How Do I Designate Those Checks As Tax Paid

How To Pay Estimated Indiana State Taxes

Dor Keep An Eye Out For Estimated Tax Payments

State Of Indiana Quarterly Premium Tax Form

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Calculating Paying Quarterly Estimated Taxes For A Small Business In Wi Giersch Group Milwaukee Wi 53202

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Received 1099r With Wrong State Tax Withheld

Fillable Online Individual Estimated Income Tax Voucher Fax Email Print Pdffiller